**

The stock market experienced a significant downturn this week, driven by fresh advancements in artificial intelligence software that have raised concerns about potential disruptions across various sectors. Investors reacted swiftly, leading to a notable sell-off as anxiety surrounding the implications of these technological strides took hold.

AI Innovations Raise Alarm Bells

The evolution of artificial intelligence has long been a double-edged sword for the economy. On one hand, these innovations promise efficiency and growth; on the other, they threaten to displace jobs and upend traditional business models. This week’s developments showcased new capabilities in AI that many believe could accelerate these disruptions, prompting a wave of caution among traders.

As major tech firms unveiled enhancements in their AI offerings, market participants began to reconsider the stability of companies that could be adversely affected. Analysts pointed out that sectors like retail, manufacturing, and even finance may face significant challenges as AI technologies become more integrated into their operations. This uncertainty was palpable in the trading sessions, leading to broad declines across major indices.

Market Response and Investor Sentiment

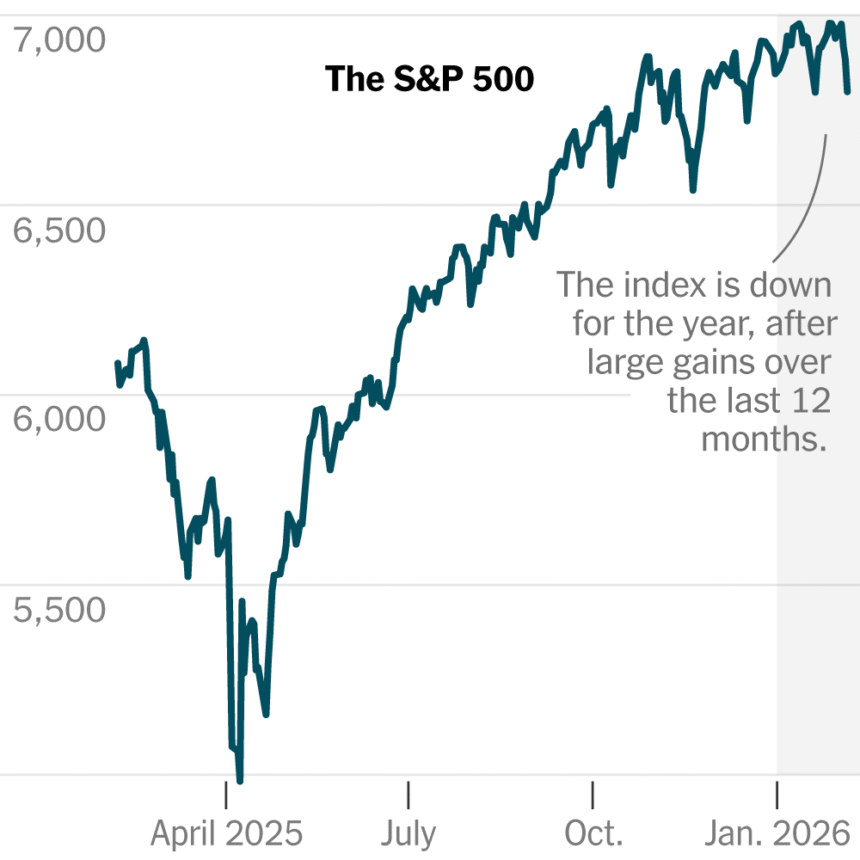

The immediate aftermath of these AI announcements was palpable, with the S&P 500 experiencing its sharpest decline in months. Investors, already on edge due to rising interest rates and a slowing global economy, appeared to be particularly sensitive to news that could signal a shift in the competitive landscape. High-flying tech stocks, which had been buoyed by previous AI excitement, took a hit as fears of regulatory scrutiny and competitive displacement became more pronounced.

Market analysts noted that while the long-term potential of AI remains promising, the short-term volatility it brings cannot be underestimated. “Investors are grappling with the reality that while AI could create new opportunities, it could also render existing business models obsolete faster than anticipated,” remarked Claudia Jensen, a senior market strategist. This sentiment contributed to a climate of fear, leading many to liquidate positions to mitigate risk.

Broader Economic Implications

The implications of this sell-off extend beyond just the tech sector. As AI technologies evolve, industries across the board will need to adapt or risk falling behind. The potential for automation to replace human workers raises critical questions about employment and economic stability. Policymakers and corporate leaders are now tasked with navigating this rapidly changing landscape, balancing innovation with the need for job security.

Moreover, the impact on consumer sentiment cannot be ignored. As companies brace for potential upheaval and reassess their workforce needs, consumer confidence may wane, leading to decreased spending. This, in turn, could exacerbate the already fragile economic recovery post-pandemic.

Why it Matters

The ripple effects of this week’s market turmoil highlight a crucial turning point in how AI will reshape the economy. As investors react to the dual-edged nature of technological advancement, the path forward will require careful navigation. The balance between embracing innovation and safeguarding economic stability will be the key challenge for businesses and policymakers alike. The sell-off serves as a reminder that while progress is inevitable, its consequences must be thoughtfully managed to avoid jeopardising the very foundations of our economy.