**

An innovative options strategy aimed at capitalising on significant stock price movements post-earnings releases has yielded exceptional returns in recent weeks, according to data from options analytics firm ORATS. The strategy, which involves purchasing both put and call options—known as straddles—has proven particularly lucrative as companies unveil their quarterly results, suggesting a heightened interest in how businesses are navigating the current economic landscape.

Understanding the Straddle Strategy

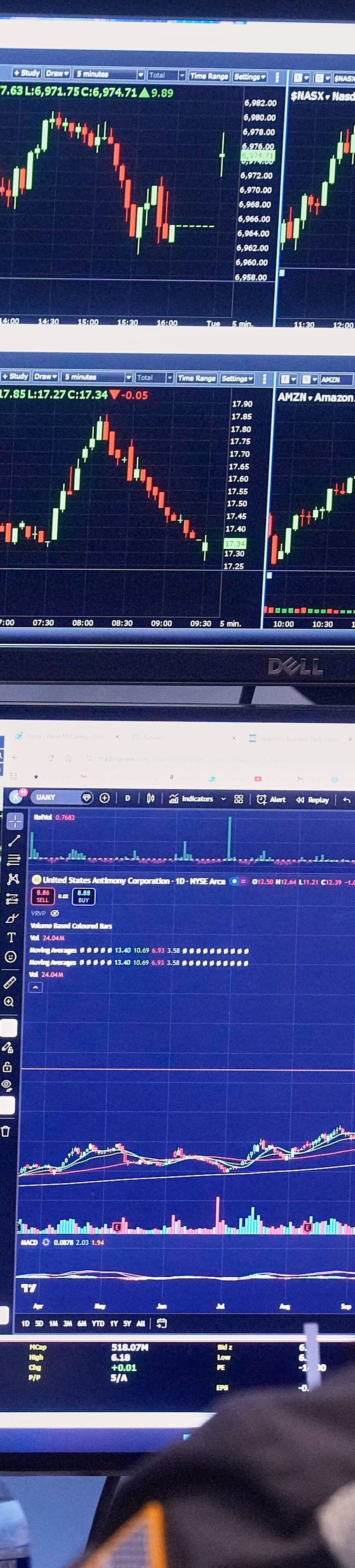

The straddle strategy allows traders to bet on price volatility without committing to a specific direction. By acquiring both a call option, which grants the right to purchase shares at a predetermined price, and a put option, which allows for selling shares, investors can profit from significant shifts in stock prices in either direction following earnings announcements.

Recent data from ORATS indicates that over the past four weeks, these options have generated an impressive average return of 45 per cent. This starkly contrasts with the mere 2 per cent return observed over the previous twelve quarters, highlighting a remarkable trend in the current earnings season.

Key Players and Market Reactions

Prominent technology firms such as Microsoft and Meta have played a significant role in driving these movements. Following their respective earnings reports, Microsoft’s stock plummeted by 10 per cent, while Meta’s shares surged by approximately the same margin. These dramatic fluctuations underscore the volatility that traders have been able to exploit through the straddle strategy.

Matt Amberson, the founder of ORATS, noted the renewed importance of earnings announcements. “Everyone wants to know how companies are faring in this economic environment and what sort of guidance they expect,” he stated. He further elaborated that positive news typically results in substantial upward movements in stock prices, whereas disappointing results lead to significant declines.

Market Conditions Favouring Straddle Traders

The current earnings season has unfolded against a backdrop of relatively low expectations for stock volatility. At the beginning of the earnings period, the Cboe Volatility Index was hovering near multi-month lows. This environment has likely contributed to a more favourable scenario for trading straddles, as the cost of entering these positions was lower, allowing investors to take advantage of potential price swings without excessive financial commitment.

As of February 12, a striking 75.4 per cent of the 353 companies within the S&P 500 that had reported earnings exceeded analysts’ expectations, according to an analysis by Tajinder Dhillon, head of earnings and equity research at LSEG Data & Analytics. This trend has not only provided opportunities for straddle traders but has also contributed to an overall heightened sense of activity in the markets.

Why it Matters

The current performance of straddle options during this earnings season not only reflects a shift in traders’ strategies but also highlights the broader implications for market dynamics amidst economic uncertainty. As companies continue to navigate a challenging landscape, investors are increasingly keen to understand their trajectories, leading to greater volatility and trading opportunities. This renewed focus on earnings results could shape trading strategies in the future, emphasising the necessity for investors to remain agile and informed in a rapidly changing market.