In a shocking revelation, three individuals have admitted to their involvement in a £70 million pension fraud scheme that exploited unsuspecting investors through the guise of a tree planting project.

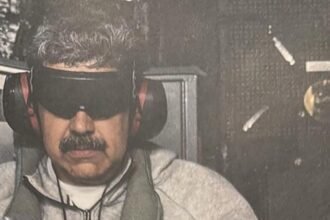

Matthew Pickard, Stephen Greenaway, and Paul Laver have all pleaded guilty to charges of fraudulent trading, shedding light on a complex web of deceit that has left many victims financially devastated.

The trio, who operated a company called Forestry for Life, convinced hundreds of people to transfer their pensions into the scheme, promising lucrative returns from the purported tree planting venture. However, the reality was far from the rosy picture they painted.

According to the investigation, the majority of the funds raised were not used for the intended purpose of planting trees. Instead, the money was siphoned off, with the defendants using it for their own personal gain, including funding lavish lifestyles and making payments to other fraudulent schemes.

“This was a brazen and cynical attempt to exploit people’s hard-earned savings,” said a spokesperson for the Serious Fraud Office, the agency leading the investigation. “The defendants deliberately misled investors, robbing them of their financial security and dreams for the future.”

The case has sent shockwaves through the financial community, raising concerns about the vulnerability of pension holders and the need for stronger regulations to protect against such scams.

“We are committed to pursuing those who seek to undermine the integrity of the financial system,” the spokesperson added. “This case serves as a stark warning to anyone considering engaging in similar fraudulent activities.”

The trio are scheduled to be sentenced in the coming months, with the court expected to hand down substantial prison terms to reflect the scale and impact of their crimes.

For the victims, the road to recovery will be long and arduous, as they grapple with the emotional and financial toll of this betrayal. Experts have urged those affected to seek professional support and advice to navigate the complex legal and financial landscape.

This case serves as a sobering reminder of the importance of due diligence and the need for investors to be vigilant when it comes to their financial decisions, particularly when it comes to pension investments.