**

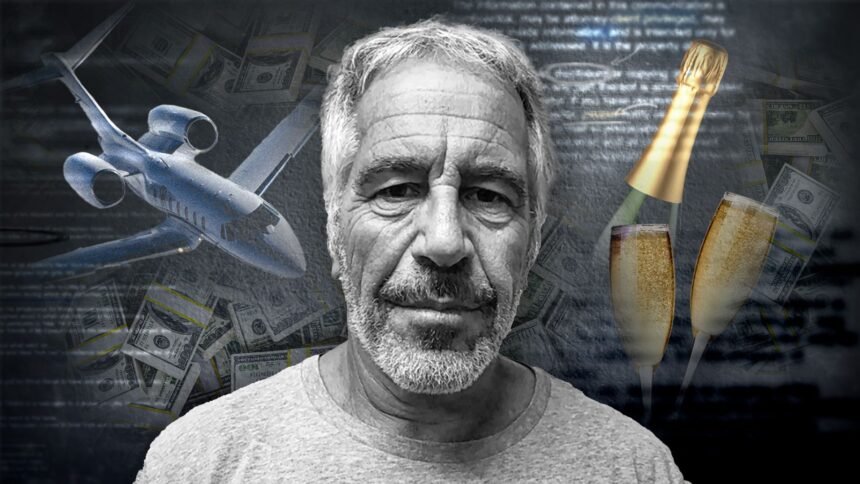

Jeffrey Epstein, a figure synonymous with controversy, amassed significant wealth that not only granted him power but also influence across various sectors. His financial journey is steeped in enigma, weaving through a tapestry of investment strategies, high-profile connections, and a network that extended into elite circles.

The Foundation of Epstein’s Fortune

Epstein began his career in the finance sector, initially as an educator at the Dalton School in New York City before transitioning into banking. His entry into the financial world was marked by a position at Bear Stearns, where he made a name as a trader. Using this as a springboard, he founded his own financial consulting firm, J. Epstein & Co., which primarily catered to wealthy clients.

Over the years, Epstein’s financial operations became increasingly opaque, often attracting scrutiny. He claimed to manage the wealth of billionaires, although the exact nature of these relationships remains unclear. Allegations suggest that Epstein’s financial dealings were not entirely above board, with whispers of potential connections to illicit activities that may have bolstered his income.

High-Profile Connections and Influence

Epstein’s wealth was not merely a product of shrewd investments; it was also significantly bolstered by his ability to cultivate relationships with influential individuals. He developed ties to prominent figures across various sectors, including politics, academia, and entertainment. This extensive network provided him access to resources and opportunities that further enhanced his financial standing.

Notably, Epstein was known to associate with high-profile personalities, including former presidents, business magnates, and prominent scientists. These connections not only amplified his social capital but also positioned him as a figure of intrigue and power. However, the nature of these associations has come under intense scrutiny, particularly in light of the serious allegations surrounding his activities.

The Enigmatic Financial Model

Epstein’s financial model has been described as unconventional, often relying on a blend of traditional investment strategies mixed with speculative ventures. He purportedly engaged in private equity and hedge fund investments, although the full extent of his portfolio remains largely undisclosed. His financial practices were marked by a lack of transparency, raising questions about the sustainability and legality of his wealth-generating strategies.

Moreover, Epstein’s financial dealings have led to investigations that have exposed potential links to sex trafficking and exploitation. These revelations have sparked widespread condemnation and have severely tarnished his legacy. The complexities of his financial empire are still being unravelled, with many details remaining shrouded in mystery.

Why it Matters

Understanding the financial underpinnings of Jeffrey Epstein’s wealth is crucial not only for comprehending his rise to power but also for examining the broader implications of unchecked influence in society. His case highlights the intersections between wealth, power, and morality, prompting a reevaluation of how financial systems can be manipulated. As investigations continue, the ramifications may extend beyond Epstein, shedding light on how wealth can shield individuals from accountability and the potential consequences of elite networks operating outside the bounds of ethical conduct.